Should Inheritance Be Considered in Retirement Planning?

When clients ask, “Do I have enough to last through retirement?”, it’s often one of the biggest and most emotional questions they face. After nearly 27 years as a financial…

The World Is Your Market: Invest Like It

Despite a slowdown in Australian economic and productivity growth in the last five years, Australia’s economy is usually considered strong and resilient when compared with other developed nations. Given our…

Lessons From My Mentor: Peter Thornhill’s Guide to Long-Term Investing

As a young financial advisor attending my first industry conference in early 2001, I was fortunate to meet someone who would profoundly shape my investment philosophy: Peter Thornhill. His guidance…

Super contributions explained . . . easily

A client once shared a poignant regret:

“When I was working and the kids were young, I saved too much. It restricted what we did when the family was together.”…

Why I Choose Direct Investing: Lessons from Experience

Over the last 20 years, I’ve shaped my investment philosophy and business around one central idea: direct investing. Rather than relying heavily on managed funds or exchange-traded funds (ETFs), I…

Quarterly Economic Update: Feb-Apr 2025

A client once shared a poignant regret:

“When I was working and the kids were young, I saved too much. It restricted what we did when the family was together.”…

Helping Your Kids Buy Their First Home Without Stealing Their Dreams

Buying a home in Australia has become a monumental challenge. With skyrocketing property prices and average mortgage debts exceeding $600,000, many young Australians feel homeownership is out of reach. As…

Avoid Lifestyle Inflation

A client once shared a poignant regret:

“When I was working and the kids were young, I saved too much. It restricted what we did when the family was together.”…

How the Media Fuels Fear During Market Volatility (and How Smart Investors Win)

Market volatility is a natural part of investing in global share markets. Over the past 26 years as a financial adviser, one lesson has stood out: while short-term market movements…

Understanding Managed Funds

A client once shared a poignant regret:

“When I was working and the kids were young, I saved too much. It restricted what we did when the family was together.”…

“Equity Mate”: Why Borrowing Against Your Home Isn’t Always a Smart Move

Remember that old ad with the guy proudly polishing his boat while his neighbor asks, “How do you afford all this?” His response—“Equity, mate”—has stuck in the Australian psyche for…

Wait! Before you buy that…

A client once shared a poignant regret:

“When I was working and the kids were young, I saved too much. It restricted what we did when the family was together.”…

Becoming Wealthy Slowly: The Most Reliable Path to Financial Freedom

Everyone wants to become wealthy. There’s no shortage of information on how to achieve it, but much of that information is filled with noise, distractions, and, more often than not,…

Spending a Dollar to Save 30 Cents: The Risk of Tax-Driven Investment Decisions

Australians love a good tax deduction. It’s almost ingrained in us—if there’s a way to pay less tax, we’re all ears. But what happens when tax savings become the main…

What happens to my superannuation if…?

A client once shared a poignant regret:

“When I was working and the kids were young, I saved too much. It restricted what we did when the family was together.”…

-

How much is Enough? The Retirement Balancing Act

-

How Advice Changed Everything: Real Clients, Real Outcomes

-

EOFY Checklist: What’s Worth Thinking About Now

-

Just Retired? Now What?

-

How Much Do You Need to Retire? The 4% Rule Makes It Easy

-

$3M Super Tax Explained (& How to Prepare)

-

Is Super still Super?

-

Rethinking Retirement for a Longer Life

-

Riding the Market Roller Coaster: What History Teaches Us About Investing

-

Market Volatility Explained – And What to Do

-

Spotting Financial Procrastination: Are You Guilty of It?

-

Australia's Elite Investors: What you can learn

-

Invest Wisely to Retire Early

-

The Biggest Money Mistakes before Retirement

-

Building Wealth the Right Way

How to invest: Secrets learnt from 20+ years in finance

Presented by Rob Goudie, CFP, Grad Dip FP For the past 20+ years Rob has been working with superannuation investors, small business owners (including farmers) and direct share enthusiasts who…

How to pay off your Home Loan FASTER!

Presented by Rob Goudie, CFP, Grad Dip FP Live a life where you are in control of your finances so you can focus on what’s really important to you! We…

Beating Mortgage Stress

Presented by Rob Goudie, CFP, Grad Dip FP Beating Mortgage Stress: How to recognise it and how to fix it! With the number of borrowers behind in their mortgage repayments…

Investing In The Right Asset Class

Presented by Peter Thornhill ‘”Absolute gold” for determining where to invest’ – Rob Goudie Wanting to understand the best areas to invest to get the best results for your savings?…

Beginners Guide to Super

There are many parts to Australia’s superannuation system, but with a basic understanding it all begins to make perfect sense and the earlier you understand it, you’ll have confidence to…

How Super Works

It’s never too early to start thinking about your super. Superannuation, or ‘super’, is money saved now, for you to enjoy in your retirement. Your employer should pay 9.5% of…

Understanding Credit Cards

So… one of the biggest mistakes we can make is using a credit card without really understanding how it works. Credit cards can save you money, or they can completely…

Planning for Aged Care Webinar

Don’t miss our exclusive “Planning for Aged Care” seminar, specially designed to help you secure a comfortable future. With medical advancements increasing longevity, aged care is becoming a reality for…

Investing Insights eBook

Are you overwhelmed by the complexities of the investment world? “Investing Insights: Your Essential Guide” is here to simplify the journey. In this user-friendly guide, we break down investment concepts…

How to Retire Well eBook

Let’s explore what retirement really means – it’s not just about the dollars, but about findingnew purposes, interests, and connections. In this book, we dig into how having a reason…

Financial Independence eBook

Unlock the path to financial freedom with “THE FIVE KEY COMPONENTS of FINANCIAL INDEPENDENCE.” This insightful eBook lays out a roadmap to take control of your finances, starting with a…

Investing In Your Future eBook

Unlock the power of your superannuation with “Investing in Your Future! EVERYTHING you wanted to know about SUPER.” This comprehensive eBook demystifies the complexities of superannuation, offering easy-to-understand insights on…

Life Insurance eBook

Secure your peace of mind with ‘Protecting What Matters Most!’ Dive into the world of Life Insurance with these 4 essential insights. While it may not be the most exciting…

Financial Freedom Starts Here! eBook

Unlock the path to Financial Freedom with ‘Financial Freedom Starts Here!’ This eBook outlines 5 crucial steps to help you take control of your financial future. From breaking the cycle…

Super Cheat Sheet eBook

Discover the ultimate Superannuation Cheat Sheet, unveiling FIVE PROVEN WAYS to safeguard your retirement and investment income. Take control with 5 essential steps to personalise your investment strategy, explore property…

Home Loan Nightmares eBook

Unearth the secrets of Home Loan NIGHTMARES in this eye-opening eBook. Discover the five things the bank doesn’t want you to know. Gain clarity and confidence as you explore Dirty…

Aged Care eBook

Unlock the secrets of Aged Care planning with our comprehensive eBook. Discover the critical first step of assessment by the Aged Care Assessment Team and craft a smart funding strategy…

Selling the Farm eBook

Discover the essential steps to successfully SELLING THE FARM in this insightful eBook. With decades of hard work behind you, it’s time to explore why selling may be the right…

Should Inheritance Be Considered in Retirement Planning?

When clients ask, “Do I have enough to last through retirement?”, it’s often one of the biggest and most emotional questions they face. After nearly 27 years as a financial…

Lessons From My Mentor: Peter Thornhill’s Guide to Long-Term Investing

As a young financial advisor attending my first industry conference in early 2001, I was fortunate to meet someone who would profoundly shape my investment philosophy: Peter Thornhill. His guidance…

Why I Choose Direct Investing: Lessons from Experience

Over the last 20 years, I’ve shaped my investment philosophy and business around one central idea: direct investing. Rather than relying heavily on managed funds or exchange-traded funds (ETFs), I…

Helping Your Kids Buy Their First Home Without Stealing Their Dreams

Buying a home in Australia has become a monumental challenge. With skyrocketing property prices and average mortgage debts exceeding $600,000, many young Australians feel homeownership is out of reach. As…

How the Media Fuels Fear During Market Volatility (and How Smart Investors Win)

Market volatility is a natural part of investing in global share markets. Over the past 26 years as a financial adviser, one lesson has stood out: while short-term market movements…

“Equity Mate”: Why Borrowing Against Your Home Isn’t Always a Smart Move

Remember that old ad with the guy proudly polishing his boat while his neighbor asks, “How do you afford all this?” His response—“Equity, mate”—has stuck in the Australian psyche for…

Becoming Wealthy Slowly: The Most Reliable Path to Financial Freedom

Everyone wants to become wealthy. There’s no shortage of information on how to achieve it, but much of that information is filled with noise, distractions, and, more often than not,…

Spending a Dollar to Save 30 Cents: The Risk of Tax-Driven Investment Decisions

Australians love a good tax deduction. It’s almost ingrained in us—if there’s a way to pay less tax, we’re all ears. But what happens when tax savings become the main…

Why Budgeting Sucks (and What to Do Instead)

Why Traditional Budgeting Fails We’ve all been told that the key to managing money is to create a budget and stick to it. Track every dollar, set spending limits, and…

Numbers vs. Emotions: The Real Game of Investing

When people think about investing, they often focus on the numbers: analysing balance sheets, forecasting earnings growth, understanding sectors, and evaluating dividend yields and price-to-earnings ratios. While these elements are…

Helping Your Kids Financially: Why Timing Matters More Than Amount

As a financial adviser, one of the most common discussions I have with clients is about helping their children financially. For those with the means, the question isn’t if they…

The Regret of Over-Saving: How to Balance Financial Goals and Family Moments

A client once shared a poignant regret: “When I was working and the kids were young, I saved too much. It restricted what we did when the family was together.”…

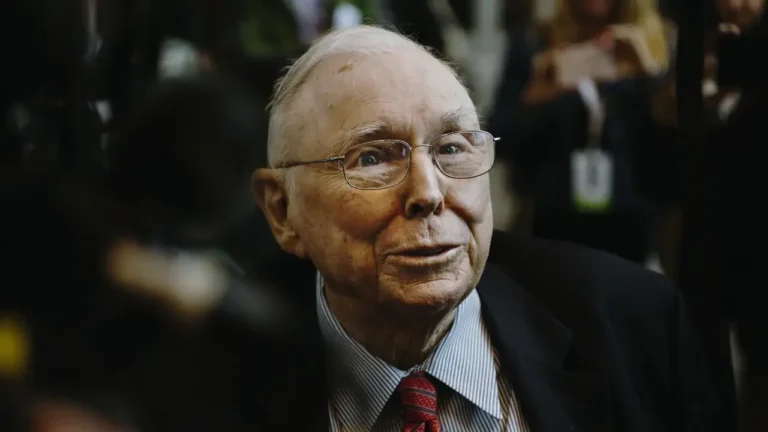

The Big Money is in the Waiting: Lessons from Charlie Munger

As a financial adviser, I often find inspiration in the words of seasoned investors who have spent decades mastering their craft. While Warren Buffett tends to grab the spotlight, his…

The Risks of Home Bias: Why You Need to Look Beyond the ASX

Australian investors have long been known for their strong bias toward local markets. It’s understandable—people invest in what they know and trust. However, relying solely on the Australian Stock Exchange…

Why I Stop Retirement Projections in the Early to Mid-80s (and Why It Matters)

When I run retirement projections for clients, one thing I do differently is stop the projections in the early to mid-80s—despite knowing there’s a high probability that one partner in…

General Advice Warning

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.