The Big Money is in the Waiting: Lessons from Charlie Munger

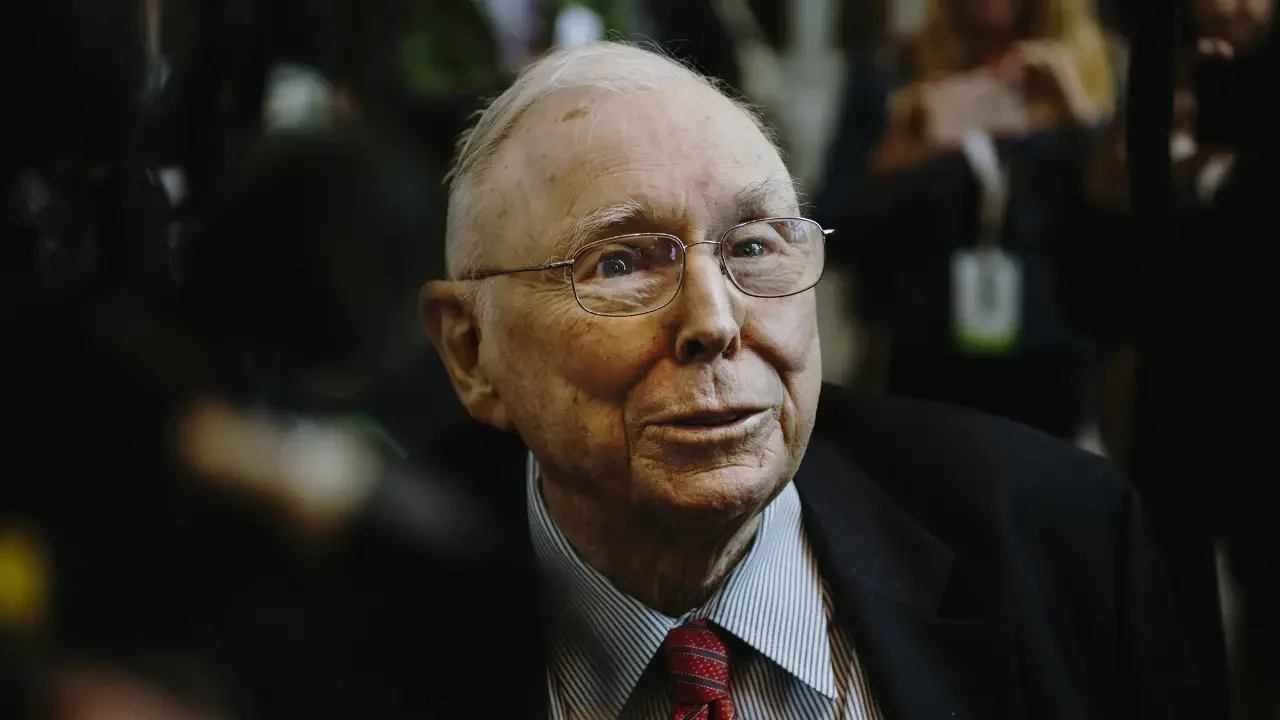

As a financial adviser, I often find inspiration in the words of seasoned investors who have spent decades mastering their craft. While Warren Buffett tends to grab the spotlight, his longtime business partner at Berkshire Hathaway, Charlie Munger, is a treasure trove of wisdom in his own right. Among his many memorable quotes, one stands out as my all-time favorite:

“The big money is not in the buying and selling, but in the waiting.”

At first glance, it might seem overly simple. But when you unpack it, this quote captures the essence of successful investing. Let’s break it down and explore what makes it so powerful.

1. Waiting for Opportunities

The first lesson from Munger’s quote is about timing your entry into the market. Markets naturally cycle between periods of greed and fear, and it’s during these fluctuations that opportunities arise for those who are patient. Crashes and corrections, though unsettling, present chances to buy high-quality businesses at discounted prices.

Warren Buffett echoes this sentiment with his famous advice:

“Be fearful when others are greedy, and be greedy when others are fearful.”

During moments of peak pessimism, when markets may drop 50% or more, those with the courage to invest often see the greatest rewards over time. It’s not about chasing daily fluctuations—it’s about waiting for the right moments when the market presents a bargain.

2. Waiting While You Hold

The second layer of Munger’s wisdom is about the patience required after you’ve invested. This is where long-term thinking becomes crucial. Once you’ve purchased shares in a high-quality business, the real value comes from holding on and allowing the people running that business to do what they do best: innovate, grow, and improve.

Businesses are driven by human endeavor—the passion and purpose of the people behind them to make things better. No one starts a company with the intention of running it into the ground. Over the years and decades, this relentless drive to improve translates into better products, increased revenue, and rising profitability.

3. The Power of Compounding

The third, and arguably most important, component of waiting is time itself—and the magic of compounding.

Compounding interest occurs when your earnings generate earnings of their own. Over decades, this creates exponential growth, not just in your investments but also within the businesses you own. High-growth companies often reinvest a significant portion of their profits—sometimes more than 40%—to fuel future growth. This reinvestment supercharges the compounding effect, driving long-term value for shareholders.

Think about it this way: as these companies reinvest profits into areas like innovation, technology, or artificial intelligence, they’re setting the stage for even greater returns in the future. For patient investors, the rewards of compounding over time can be truly transformative.

A Lesson in Investor Psychology

At its core, Munger’s quote is about investor psychology. Successful investing requires:

- Patience to wait for the right opportunities.

- Discipline to hold on through market ups and downs.

- Confidence to trust in the long-term potential of the businesses you own.

It’s not about reacting to every market headline or trading frenzy. Instead, it’s about understanding when to be greedy and when to be fearful—and having the resolve to act accordingly.

Final Thoughts

Charlie Munger’s insight that “the big money is not in the buying and selling, but in the waiting” is a timeless reminder of what it takes to succeed as an investor. It’s about more than strategy or analysis; it’s about the psychology of patience and the discipline to stay the course.

So next time you feel the urge to check your portfolio for the 10th time in a week, take a moment to reflect on Munger’s wisdom. Remember, the real gains aren’t made in the buying or the selling—they’re made in the waiting.

As always, this is general advice only. For personalised guidance, speak to a qualified financial adviser who can help tailor strategies to your goals and circumstances.

The information provided in this article is general in nature only and does not constitute personal financial advice.