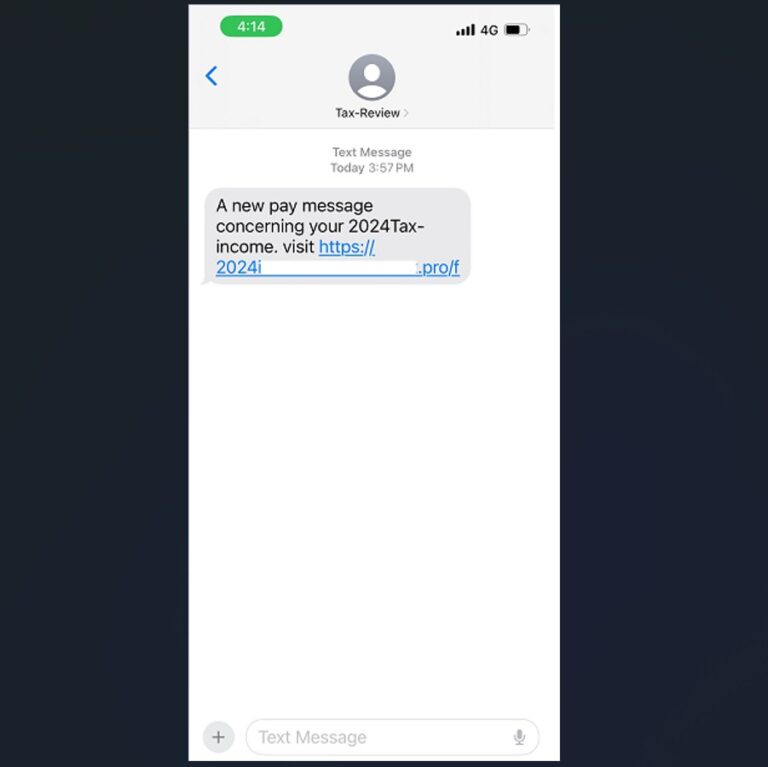

How to avoid scams when completing your tax return

CPA Australia Australians should always be wary of online scams, but we are particularly vulnerable at tax time. Cyber criminals use a mix of tried-and-tested and new methods to attempt…

CPA Australia Australians should always be wary of online scams, but we are particularly vulnerable at tax time. Cyber criminals use a mix of tried-and-tested and new methods to attempt…

Adjusting to life after divorce, particularly later in life, is akin to navigating through some of life’s most challenging events, psychologists say. It’s a journey comparable to coping with loss,…

CPA Australia No one likes being treated as just a number, but with millions of returns and tens of billions of dollars at stake, that’s the reality when it comes…

Looking to give your super a boost before the end of the financial year? Look no further! Follow these five strategies to maximise your contributions and make the most of…

Australian Taxation Office As ‘tax time’ approaches, the Australian Taxation Office (ATO) has announced it will be taking a close look at 3 common errors being made by taxpayers: •…

In his 2024 Federal Budget speech, treasurer, Jim Chalmers, announced that ‘The number one priority of this government and this Budget is helping Australians with the cost of living’. But…

When it comes to getting the most (money) from your annual tax return, there is usually a lot to think about, so we’ve identified a few options that could open…

A year before retirement, Tess’s superannuation plan was on track, and she was imagining her post-work life. With savings of $34,000 at the bank, she was looking to park it…

The first quarter of 2024 saw the Government roll out considerable changes to the Stage 3 Tax Cuts, inflation continuing to slow but remaining stubbornly high across some areas, surging…

Generally speaking, we Australians are pretty financially savvy, that is, we understand the how and why of effectively managing our money. Unfortunately, that doesn’t mean we’re actually putting that know-how…

No matter what kind of job you have, there is always a possibility of falling sick or getting injured, regardless of the type of work you do. That’s why every…

Australian Bureau of Statistics, (ABS) figures indicate that between 2017-2018 and 2019-2020 total average household debt rose from $190,000 to $204,000. That’s an increase of over 7% in two years! …

What does financial freedom mean to you? The ability to travel the world and build a dream home? Or to be able to enjoy a simple but active retirement, and…

Resilience is the ability to quickly recover from setbacks, and while setbacks can come in many forms most of them will have a financial component. So what can you do…

Ever glanced at a list of different managed funds and wondered why some have remarkably low fees compared to others? Chances are, the ones with lower fees are index funds,…

Every January, countless school leavers across Australia embark on their job-hunting journey. A NSW Government survey conducted in 2021 found that of 42,388 secondary school leavers, approximately 50% continued to…

Global growth is forecast to slow and remain below its historical average in 2024, reflective of tighter monetary policy in advanced economies, as well as a soft outlook for China….

We’ve all experienced it… the undeniable allure of post-Christmas sales. No sooner has Christmas wrapped up for the year than the frenzy of Boxing Day Sales descends upon us. Every…

When you’re at the helm of your own business, it’s easy to get caught up in the whirlwind of the present – chasing sales, generating leads, and growing your business….

Caring for a loved one can be deeply fulfilling but brings its fair share of challenges too – as Laura discovered. When her mother Shelly had a stroke, she didn’t…

In the ever-fluctuating world of economics, recessions are an inevitable part of the financial cycle. While they can be daunting, understanding their nature and preparing for their impact can make…

The dream of retiring young is one that captivates many peoples’ imaginations. The freedom to live life on your own terms, doing what you want, when you want is undeniably…

Australia’s annual inflation rate has taken an unexpected step up, increasing pressure on the Reserve Bank to push interest rates higher and once again raising the prospect that Australia will…

Spring is the perfect time to rejuvenate your financial habits as well as your garden! Here are 5 ways to set you, and your garden, up for success: 1. Plan…

End of content

End of content