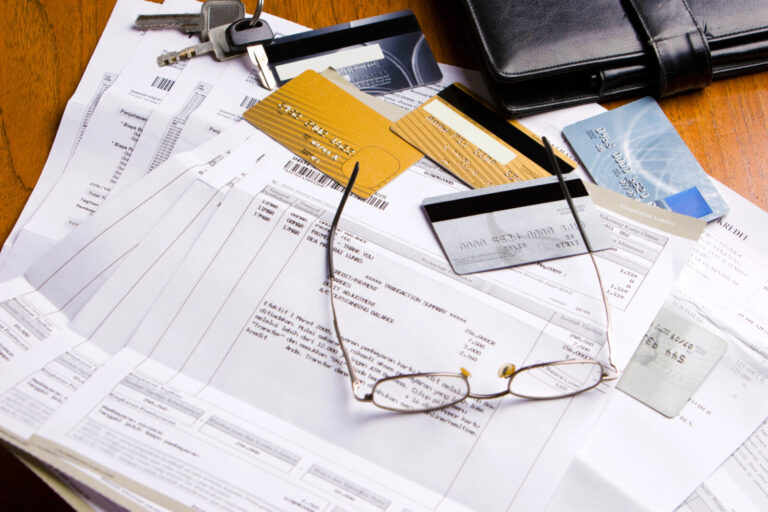

Cheer today, debt tomorrow

From early November retailers have been telling us what we can’t live without and what our kids must have if they are to still love us on Christmas Day. It’s easy to get caught up in the momentum. Of course, the downside is you end up with the post-Christmas blues when the credit card statements arrive. This may mean that wealth plans get scrapped because you have to pay off the debt first.