How to save tax in Australia

Rob & Amy discuss all things tax this week, exploring the tax implications of investment properties, and how Aussies use negative gearing as an investment strategy. They also challenge the…

Rob & Amy discuss all things tax this week, exploring the tax implications of investment properties, and how Aussies use negative gearing as an investment strategy. They also challenge the…

In this episode, Rob & Amy walk you through what to expect during your first visit to a financial adviser. From understanding your financial goals to discussing strategies for your…

FORO – the fear of running out. I’d never heard the expression until I met Mark and Susan. Of course I’d heard of FOMO, the fear of missing out, but…

Just as the name of this podcast implies, retirement is often more about the simple pleasures than the big, costly dreams we might have imagined during our working years. This…

For many Australians, particularly young Australians, the dream of home ownership is often accompanied by the reality of carrying student loans, known as HECS-HELP debt. Understanding the impact of HECS…

Does your Money Mindset have your back? Or… Is it holding you back? If you’ve never really thought about it, you’d be forgiven. When it comes to our financial success,…

In this episode, join financial advisers Rob & Amy as they delve into essential strategies to maximise your End of Financial Year (EOFY). Learn how to achieve significant tax wins…

This week we said goodbye to tech stock Altium from the Australian share market as its buyout by Renesas was officially completed… As a result, large cash payouts have been…

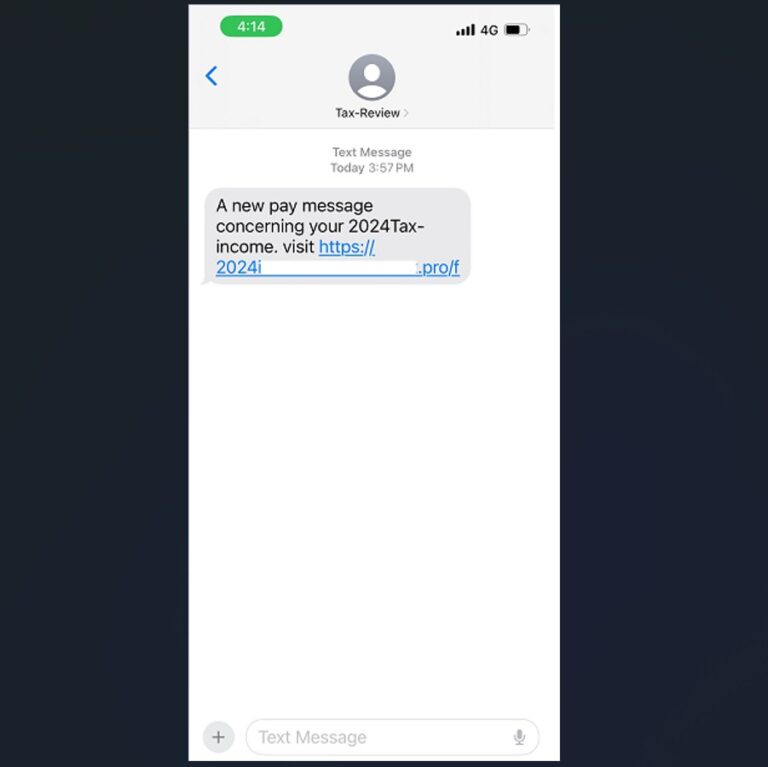

In a recent media release, the Australian Securities and Investments Commission (ASIC) warned about a new scam doing the rounds. Scammers attempt, through cold calls to superannuation savers, to extract…

The new financial year provides an opportunity for a fresh start for your finances. Make this the financial year you get on top of yours… for good! We’ve broken it…

The economy continues to slow, with inflation remaining sticky, the new federal budget making waves, and global events that may have a significant impact. Uncertainty at home and abroad The…

In this episode, we provide essential advice for a fulfilling and financially secure retirement. We discuss the importance of balancing frugality with enjoying your time and making memories. Staying active…

CPA Australia Australians should always be wary of online scams, but we are particularly vulnerable at tax time. Cyber criminals use a mix of tried-and-tested and new methods to attempt…

In this episode, we walk you through the essential steps to finding the right financial adviser for you. From using online tools (like Adviser Ratings and Google Reviews), and seeking recommendations from…

Adjusting to life after divorce, particularly later in life, is akin to navigating through some of life’s most challenging events, psychologists say. It’s a journey comparable to coping with loss,…

In this episode, Financial Advisers Rob & Amy share essential tips for graduates to kickstart their financial journey. Discover the key steps you should take to manage your finances effectively,…

CPA Australia No one likes being treated as just a number, but with millions of returns and tens of billions of dollars at stake, that’s the reality when it comes…

Looking to give your super a boost before the end of the financial year? Look no further! Follow these five strategies to maximise your contributions and make the most of…

Australian Taxation Office As ‘tax time’ approaches, the Australian Taxation Office (ATO) has announced it will be taking a close look at 3 common errors being made by taxpayers: •…

In his 2024 Federal Budget speech, treasurer, Jim Chalmers, announced that ‘The number one priority of this government and this Budget is helping Australians with the cost of living’. But…

Join us as we dissect the current investment market, analysing recent trends, discussing the surge in market values and what it means for our investment portfolios. Who determines if things…

When it comes to getting the most (money) from your annual tax return, there is usually a lot to think about, so we’ve identified a few options that could open…

Unlock the secrets to investing for minors in our latest episode! From adult-managed trusts to tax rules, we’ve got you covered. Discover strategies to mitigate tax impact and explore alternative…

“Increase the memories to reduce the regret” – Rob Goudie From the adventurous “Go-Go Years”, to the reflective “Slow-Go Years” and the contemplative “No-Go Years,” we explore the three phases…

End of content

End of content