Quarterly Economic Update: October to December 2025

The December quarter has been defined by unexpected twists. Just as we thought inflation was under control, it kicked back up. Just as rate cuts seemed certain for 2026, we’re…

The December quarter has been defined by unexpected twists. Just as we thought inflation was under control, it kicked back up. Just as rate cuts seemed certain for 2026, we’re…

There’s a growing issue facing families today, and it spans three generations. At the heart of it is the younger generation—the first-time homebuyers—who are struggling to break into the property market. This challenge isn’t just theirs to bear; it’s one that also involves their parents and grandparents, who want to see them succeed but are grappling with how to provide the right kind of support without overstepping or creating dependency.

Despite the temporary, sudden downturns caused by the 2007-2009 global financial crisis and the 2020-2021 COVID pandemic, the value of the ASX increased by more than 160% between 2000 and 2024, as evidenced by the growth in the ASX 200 market index. This demonstrates that it’s better to invest in a variety of shares rather than sticking to just a few.

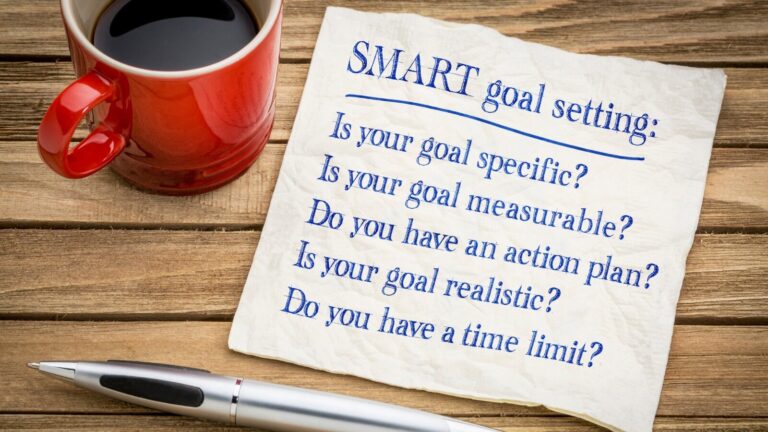

In the context of your personal finances, SMART refers to setting clear, quantifiable, feasible and appropriate financial objectives, to be carried out within a defined time frame. You’re much more likely to succeed if you avoid vague, non-measurable, unrealistic and inappropriate aims with no actual deadline. Relying on SMART goals will help you stay on track as you shape your financial future.

Over the last few years, I’ve taken on the management of many self-managed superannuation funds (SMSFs), and in doing so, I’ve encountered a particular investment type that often causes significant…

The idea of downsizing can be very appealing to empty-nesters. There will be less cleaning, gardening and maintenance, more time for hobbies and travel, and the icing on the cake comes if you can use the cash surplus you created to give your super a significant tax-effective boost.

But is the picture totally rosy, or are there some drawbacks to downsizing?

When it comes to investing, most people focus on picking the right stocks, finding the best superannuation fund, or minimising their tax bill. And don’t get me wrong, these things…

A client once shared a poignant regret:

“When I was working and the kids were young, I saved too much. It restricted what we did when the family was together.”

This simple reflection struck a chord with me. It got me thinking about the delicate balance between saving for the future and living fully in the present. While we all know the importance of financial security, is it possible to save too much—at the expense of the moments that matter most?

Australians love a good tax deduction. It’s almost ingrained in us—if there’s a way to pay less tax, we’re all ears. But what happens when tax savings become the main…

When people think about investing, they often focus on the numbers: analysing balance sheets, forecasting earnings growth, understanding sectors, and evaluating dividend yields and price-to-earnings ratios. While these elements are…

Adjusting to life after divorce, particularly later in life, is akin to navigating through some of life’s most challenging events, psychologists say. It’s a journey comparable to coping with loss,…

Resilience is the ability to quickly recover from setbacks, and while setbacks can come in many forms most of them will have a financial component. So what can you do…

In the ever-fluctuating world of economics, recessions are an inevitable part of the financial cycle. While they can be daunting, understanding their nature and preparing for their impact can make…

The newest generation of young investors were raised during the Age of Information. Growing up alongside the internet, this generation has been exposed to more information and technological advancement than…

As investors navigate through unpredictable and volatile economic times, it is essential to consider asset classes that can provide a level of stability and protection against market fluctuations. One such…

While retirement should be the best years of your life, many Australians make simple, avoidable mistakes with their finances that can leave them without the funds to really enjoy life….

Did you have a savings account when you were young? It wasn’t uncommon and those old Passbook accounts funded many a first car. Now you’re a parent, are you thinking…

You’re young, expecting a satisfying future brimming with friends, family and a comfortable lifestyle. You’re a Next Generation Investor, likely aged between 18 and 25, and you’re starting to think…

For most Australians, their 60s is the decade that marks retirement. For some this means a graceful slide into a fulfilling life of leisure, enjoying the fruits of a lifetime…

One of the keys to financial success is to adopt the right strategy at the right time. As you move through the stages of life, here are some tried and…

The potential financial results of investing can feel limitless, and it can be tempting to think that just one stock pick could make you an overnight millionaire. Yes, stock-picking can…

End of content

End of content