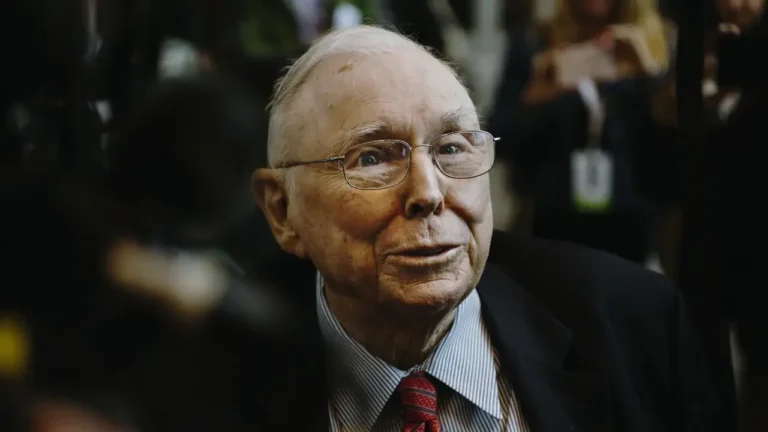

The Big Money is in the Waiting: Lessons from Charlie Munger

As a financial adviser, I often find inspiration in the words of seasoned investors who have spent decades mastering their craft. While Warren Buffett tends to grab the spotlight, his…

As a financial adviser, I often find inspiration in the words of seasoned investors who have spent decades mastering their craft. While Warren Buffett tends to grab the spotlight, his…

The final quarter of 2024 reflected a mixed economic landscape. While consumer spending and equity markets showed resilience, persistent inflation, cost-of-living pressures and a cooling housing market have tempered optimism….

Australian investors have long been known for their strong bias toward local markets. It’s understandable—people invest in what they know and trust. However, relying solely on the Australian Stock Exchange…

Share markets are renowned for taking unexpected downturns and while history shows that markets eventually recover, this rebound in value can occasionally take time. Investors concerned about this risk might…

As a financial adviser, I often see retirees who are far more stressed and anxious about money than they need to be. Ironically, money—something that should offer freedom and peace…

Achieving a high income is a significant accomplishment. You’ve put in the hard yards, climbed the ladder, and now you’re pulling in the big bucks! But don’t be mistaken; a…

Inflation is a slow force working against your financial goals. It can quietly erode the purchasing power of your money over time. While it’s tempting to see cash as a…

Volatility is part and parcel of investing in share markets. It’s what makes them exciting when prices are climbing but equally nerve-wracking when they swing downward. As much as we’d…

The Australian economy is still growing, but things are moving slower than usual, and the Reserve Bank of Australia (RBA) is being cautious with any changes to interest rates. They’re…

There’s no shortage of financial advice out there. Everywhere you look—social media, news articles, investment forums—you’re bombarded with strategies, opinions, and predictions. And honestly? A lot of the information is…

The economy continues to slow, with inflation remaining sticky, the new federal budget making waves, and global events that may have a significant impact. Uncertainty at home and abroad The…

The first quarter of 2024 saw the Government roll out considerable changes to the Stage 3 Tax Cuts, inflation continuing to slow but remaining stubbornly high across some areas, surging…

What does financial freedom mean to you? The ability to travel the world and build a dream home? Or to be able to enjoy a simple but active retirement, and…

Resilience is the ability to quickly recover from setbacks, and while setbacks can come in many forms most of them will have a financial component. So what can you do…

Ever glanced at a list of different managed funds and wondered why some have remarkably low fees compared to others? Chances are, the ones with lower fees are index funds,…

Global growth is forecast to slow and remain below its historical average in 2024, reflective of tighter monetary policy in advanced economies, as well as a soft outlook for China….

Australia’s annual inflation rate has taken an unexpected step up, increasing pressure on the Reserve Bank to push interest rates higher and once again raising the prospect that Australia will…

In the quest for financial stability and success, we often focus on tangible elements like earning more money, saving diligently, or investing wisely. But have you ever stopped to consider the…

The newest generation of young investors were raised during the Age of Information. Growing up alongside the internet, this generation has been exposed to more information and technological advancement than…

As investors navigate through unpredictable and volatile economic times, it is essential to consider asset classes that can provide a level of stability and protection against market fluctuations. One such…

The Reserve Bank of Australia has decided to pause its cycle of interest rate hikes, keeping the cash rate target unchanged at 3.6 percent due to softening inflation data, a…

Depositing cash in a savings account or a term deposit are the most common ways to invest your money. But, how do you know which is right for you? First,…

According to the Reserve Bank of Australia, domestic headline inflation is expected to reach 8% in the final month of 2022 as consumers continue to spend despite higher interest rates….

Investment and portfolio building has traditionally been a male-dominated world, but these days more women are trading on the market – and they’re good at it! According to an ASX…

End of content

End of content